What is a Health Insurance Deductible & How does it work?

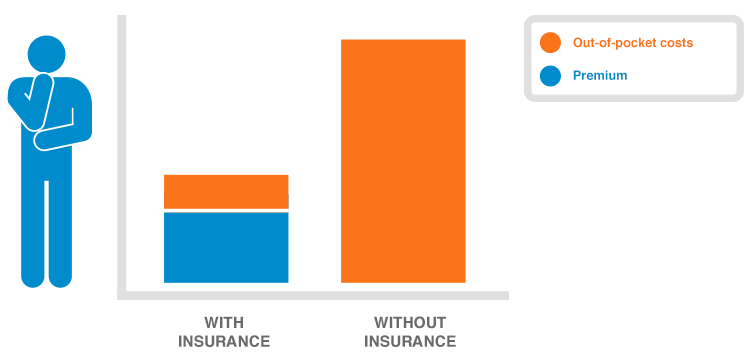

Health Insurance is the most important type of insurance that everyone needs. You can replace the car or house. You cannot replace you. Obtaining Health Insurance not only saves you money on medical services. It also grants you access to Doctors, Specialists & Facilities. Everyone has different health needs and health care requirements! Some individuals have major medical issues and require constant health care. While others are completely healthy and hardly ever go to the doctor. A basic understanding of your health status is an important aspect in choosing a plan that fits your individual needs. However, a crucial key to finding quality coverage & saving money is the understanding of a Health Plans out of pocket expenses & how they work.

What are out-of-pocket expenses?

Out-of-pocket expenses are a share of cost for medical care that you need to pay on your own, or “out of pocket.” In health insurance, your out-of-pocket expenses include deductibles, coinsurance, copays, and any services that are not covered by your health plan. The insurance company also sets a maximum amount that you’ll pay for medical expenses on your own, called an out-of-pocket maximum. The amount of cost-sharing you’re responsible for is determined by the type of Metal Tier your plan falls under (bronze, silver, gold & platinum). The easiest way to think about it is the more you pay today, the less you’re going to pay tomorrow. Bronze plans have the lowest cost monthly. However, they have the highest out of pocket expenses. Platinum plans are the highest cost monthly. But they have the lowest out of pockets when you use your insurance. Either way you go. All plans under the four metal tiers must cover the 10 essential health benefits as outlined under the affordable care act.

Common out-of-pocket expenses include:

Premiums

Premiums are your Health Plans monthly payment. The monthly premium is the first cost you pay to effectuate & maintain health insurance coverage. If you are a low-income earner, you may qualify for a premium tax credit or subsidy to help reduce your monthly premium.

Copays

Copayments are set dollar amounts you pay for covered medical services. Examples include your copay for Primary care or Specialist office visits, or a copay for an MRI or Lab work. All copay amounts will be outlined in your Summary of Benefits when purchasing a Qualified Health Insurance Plan. It is crucial to review this document with your agent before purchasing Health Insurance.

Coinsurance

Coinsurance is a cost share agreement between you and the insurance company. This amount is broken down as a percentage of the overall medical costs after you reached you deductible and before you’ve reached your annual max out of pocket. Depending on the Metal Tier your Health Plan falls under, the coinsurance amount will vary. Remember there are 4 Metal Tiers. Bronze, Silver, Gold, & Platinum. Bronze plans will have the lowest coinsurance insurance amount and platinum plans will have the highest. Meaning that your copays, deductible and max out of pocket will be higher under the Bronze plans, compared to a Platinum plans. See the chart below for a quick reference guide.

| METAL TIER | CONSUMER PAYS | INSURER PAYS |

| Bronze | 40% | 60% |

| Silver | 30% | 70% |

| Gold | 20% | 80% |

| Platinum | 10% | 90% |

Deductible

Your Health Plans deductible is the amount of money you pay before the company starts covering covered medical services. Now, some expenses outlined on your health plans summary of benefits may have a set copay. Which means those copays are not subject to paying a deductible first. Examples are Primary Care or Specialist visits and Generic Drugs. On most health plans the deductible is in place as a cost share for major medical circumstances, emergency services or high-cost procedures. For example. You need to have surgery and the cost is $10,000. Your health plans deductible is $2,000. You’ll pay $2,000 and the insurance company covers the remaining $8,000.

Out-of-pocket maximum

The Maximum out of pocket or MOOP is the most important number within a Health Plans summary of benefits. This amount stipulates the amount you will pay for 1yr in covered medical services. Once you reach this amount, the insurance company pays ALL covered medical expenses for the remainder of the year. All Copays, Coinsurance, & your Deductible is embodied into this amount and each time you pay out of pocket for covered medical expenses it reduces the amount remaining. Now, each heath plan will have a higher or lower max out of pocket depending on the metal tier in which your health plan falls under. Remember there are 4 metal tiers! Bronze, Silver, Gold & Platinum. Bronze plans will have the lowest monthly payment. However, bronze plans have the highest copays, deductibles & max out of pocket. Compared to platinum plans which have low copays, deductibles & max out of pocket and high monthly payments.

Choosing the Right Health Plan

There are a few things you need to know before choosing a Health Plan.

- A good understanding of your Health History & Needs – Are your sick or healthy? Does your family have a history of illnesses such as diabetes, cancer, or heart disease? How often do you go to the doctor? Do you have any medications? Understanding your Health needs will better help you narrow down the Health Plans available and eliminate plans that will not best for your specific needs. If your sick, are on many medications, go to the doctor frequently you may want to pay a little more per month and have a low deductible health plan. If your healthy and never go to the doctor your may want to save on the monthly pay and take a higher deductible Health Plan. Always talk to your agent to help determine which road is best!

- Budget – What can you afford to pay monthly? Now, if you’re a low-income earner you may qualify for premium tax credits, also known as subsides. These will help offset your monthly payment. However, what do you do if you do not qualify for premium tax credits? Well, you’re going to need to have an honest conversation about what you can afford monthly and what you’re willing to pay God Forbid the worst happens. A good agent will complete a Financial Risk Calculation. This determines how much you will pay worst case scenario. An agent will compare the risk exposures amongst many different plans and help you pick the one that meets your needs & budget and does not break the bank when you must utilize the coverage! Always speak to an agent to assist with this process.

- Network– Are your doctors, facilities, and local hospitals in network? This is extremely important as you need to know if your local health care providers accept your insurance. Knowing you’re in network will save you time and money when you utilize your insurance.

- Out-of-Pocket Expenses– How much will you pay when you utilize your insurance? Knowing what your copays, deductible, coinsurance and max out of pocket are the most important piece of the puzzle. If you need to have low copays because your sick or taking high-cost medications, then you need to know what those amounts are. Taking the time up front to do some math and reviewing the summary of benefits will save you thousands of dollars and a lot of frustration down the road when your need to use your insurance.

- Features and Benefits– Most Health Plans will offer consumer features and benefits depending on the Company that’s offering coverage. Some features are Vision or Dental Benefits, Gym membership discounts, Fitness supplies discounts, or even cash rewards for completing annual physicals and health questionnaires. Always review this additional value add with your Agent!

- Qualified or Non-Qualified Health Plan– Is this Health Plan an ACA Qualified Health Plan? This is extremely important as the Affordable Care Act or ACA has specific requirements that dictate what insurance carriers must cover. These requirements protect consumers and offer the highest coverage on the market. One requirement is that for a Health Plan to be considered a Qualified Health Plan, that Health Plan must offer 10 essential benefits. These benefits include Preventive, Emergency, Rehab & Maternity services, Pharmaceutical Coverage, Out of Pocket Limitations, Coverage for preexisting conditions and much more. Always ask your agent if the proposed plan is an ACA Complaint Qualified Health Plan.

Reach out to an Insurance Consultant Today

Insurance is complicated and that’s why there are Insurance Agents. Here at Landel Insurance our Agents are all Licensed and Certified with the Centers of Medicaid and Medicare Services. We offer FREE INSURNACE CONSULTATIONS! Allow our team to review your current coverage, complete a risk assessment and receive a tailored quote with coverages custom to your needs and budget. What do you have to lose?